Get the free vat 7 form pdf

Show details

Form VAT-R1 See rule 16(1) table) and 41(6(I) Original/Duplicate copy of return for the quarter ended on: 1. Dealer's identity Name and style of business Address TIN 0 6 M/S D D M M Y Contact No.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your vat 7 form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat 7 form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vat 7 form pdf online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit vat return form pdf. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

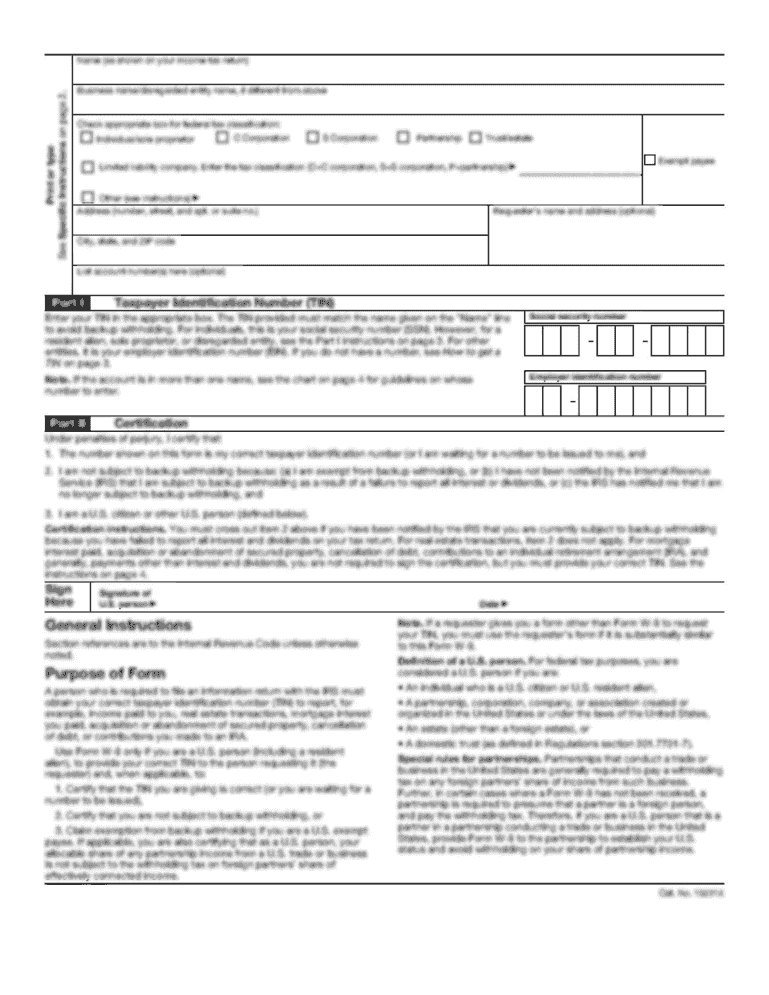

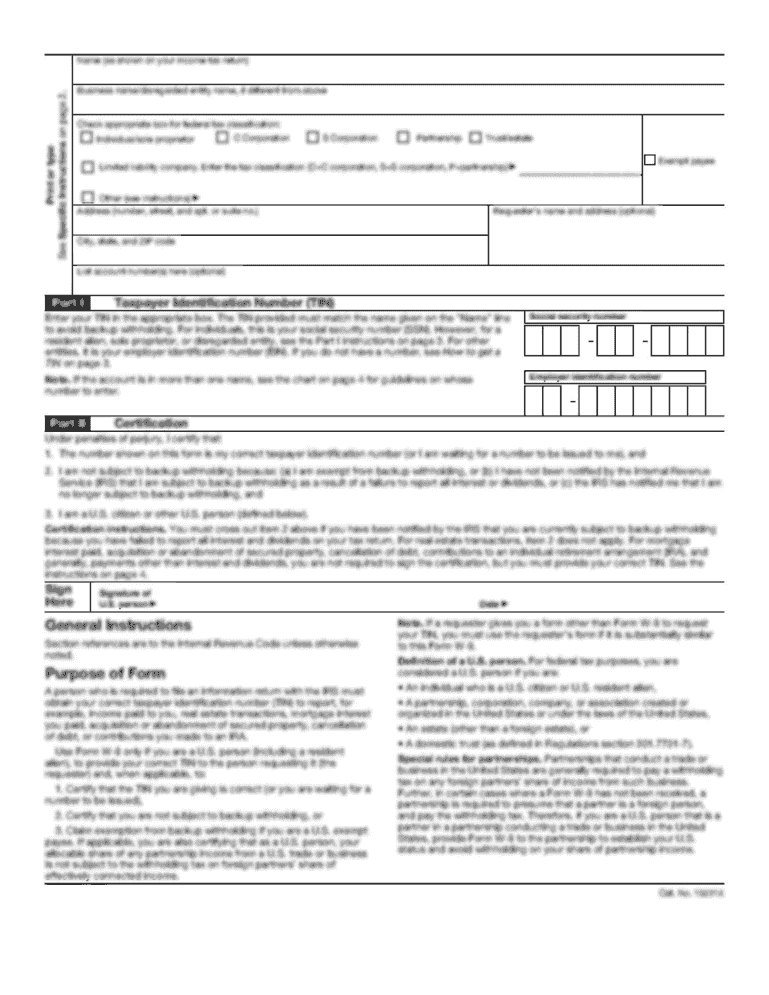

How to fill out vat 7 form pdf

How to fill out vat 7 form pdf:

01

Begin by obtaining the vat 7 form pdf from the appropriate authority or website.

02

Open the vat 7 form pdf using a pdf reader or editor software.

03

Start by filling out the top section of the form which includes your personal information such as name, address, and contact details.

04

Enter your tax identification number (TIN) or any other identification number required by your jurisdiction.

05

Proceed to the next sections of the form and provide details about your business, including its name, address, and type of business entity.

06

Fill in the relevant financial information, such as your taxable sales and purchases for the reporting period specified in the form.

07

If necessary, attach any supporting documents, such as invoices or receipts, as required by your jurisdiction.

08

Double-check all the information provided on the form to ensure accuracy and completeness.

09

Sign and date the form in the designated fields.

10

Submit the completed vat 7 form pdf to the appropriate tax authority according to their guidelines and deadlines.

Who needs vat 7 form pdf:

01

Businesses registered for Value Added Tax (VAT) in jurisdictions where the vat 7 form is required.

02

Individuals or entities that engage in taxable transactions and are obligated to report and pay VAT to the tax authorities.

03

Taxpayers who need to provide their VAT-related information to the tax authority for assessment and compliance purposes.

Video instructions and help with filling out and completing vat 7 form pdf

Instructions and Help about vat7 form pdf

Fill printable vat return form pdf : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out vat 7 form pdf?

1. Start by downloading and opening the VAT 7 form PDF from the UK government website.

2. Enter your business name, address, and VAT registration number on the form.

3. Enter the period for which the return is being filed.

4. Enter your total income, including VAT, for the period in question.

5. Enter the total VAT due for the period in question.

6. Enter the amount of VAT you are reclaiming from other EU member states.

7. Enter the total amount of VAT you are reclaiming from other EU member states.

8. Sign and date the form, then submit it to the HMRC.

What is the penalty for the late filing of vat 7 form pdf?

The penalty for late filing of a VAT 7 form is a fixed penalty of £100 for each return that is filed late. In addition, an automatic penalty of 5% of any tax due (or £30 if greater) may also be applied. If the return is more than three months late, an additional penalty of 5% of any tax due (or £30 if greater) may be applied for each additional month or part of a month that it is late.

What is vat 7 form pdf?

The VAT 7 form is a document used by businesses in the United Kingdom to register for VAT (Value Added Tax). It is used to provide information about the business, including its address, turnover, and details of its activities. The form can be completed online or in a printable PDF format.

Who is required to file vat 7 form pdf?

VAT-registered businesses are required to file VAT 7 form, also known as the VAT Return, in PDF format. This form is used to report and reconcile the VAT due and input tax claims of the business for a specific period. Businesses are obligated to submit this form to the tax authorities in their respective countries at regular intervals, typically on a quarterly basis. However, it is crucial to note that the specific rules and requirements can vary depending on the jurisdiction.

What is the purpose of vat 7 form pdf?

The VAT 7 form is a Value Added Tax (VAT) registration form used in the United Kingdom. Its purpose is to register a business for VAT, which is a consumption tax imposed on goods and services. The form collects information about the business, such as its address, nature of business, turnover, and details of the owner or company director. Once registered, the business will be required to collect VAT on its sales, file regular VAT returns, and pay the collected VAT to the tax authorities.

What information must be reported on vat 7 form pdf?

The VAT 7 form, also known as the Value Added Tax Return form, is used to report VAT information to the tax authorities. It typically requires the following information to be reported:

1. Business details: This includes the name, address, and VAT registration number of the business.

2. VAT period: The specific period for which the return is being reported, usually a quarter or a month.

3. Sales information: The total value of sales made during the VAT period, both within the country (standard-rated and zero-rated) and outside the country (exports).

4. Purchase information: The total value of purchases made during the VAT period, which includes goods and services subject to VAT.

5. VAT calculation: The amount of VAT due on sales made during the VAT period and the amount of VAT that can be reclaimed on purchases made.

6. VAT payable or reclaimable: The net amount of VAT payable to the tax authorities or the amount that can be reclaimed.

7. Other information: Any other relevant details required by the tax authorities for specific transactions or circumstances.

It is important to note that the requirements may vary depending on the tax jurisdiction and specific regulations. Therefore, it is essential to consult the official guidelines or seek professional advice to ensure accurate completion of the VAT 7 form.

How do I complete vat 7 form pdf online?

pdfFiller has made filling out and eSigning vat return form pdf easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit vat 7 form online?

The editing procedure is simple with pdfFiller. Open your vat 7 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in vat 7 pdf without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing vat 7 printable form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Fill out your vat 7 form pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vat 7 Form is not the form you're looking for?Search for another form here.

Keywords relevant to vat7 form download

Related to vat7

If you believe that this page should be taken down, please follow our DMCA take down process

here

.